interest tax shield formula

Interest Tax Shield Example. This companys tax savings is equivalent to.

Depreciation Tax Shield Formula And Calculator Excel Template

The reason why the pre-tax cost of debt must be tax-affected is due to the fact that interest is tax-deductible which effectively creates a tax shield ie.

. Next determine the interest rate to be paid by the borrower which is denoted by r. The effect of a tax shield can be determined using a formula. AfterTax Cost of Debt Formula.

To increase cash flows and to further increase the value of a business tax shields are used. Interest Expense Formula. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage interest deduction refers to the decrease in taxable income allowed to the homeowners for their interest on a home loan taken for purchase or construction of the house or any borrowings. Thus there is a tax savings referred to as the tax shield. All future courses are included in the purchase of the specialization.

Tax Shield Formula. Next determine the tenure of the loan or the period for which the loan has been extended. Following are the steps to calculate Simple Interest.

The interest expense reduces the taxable income earnings before taxes or EBT of a company. In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption. If a company has zero debt and EBT of 1 million with a tax rate of 30 their taxes payable will be 300000.

The course is included in the specialization program and will be released in. Adjusted Present Value - APV. Firstly determine the outstanding loan amount extended to the borrower denoted by P Step 2.

Here is the formula to calculate interest on the income statement. Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below.

Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation expense. Companies using accelerated depreciation methods higher depreciation in initial years are able to save more taxes due to higher value of tax shield. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any financing benefits.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

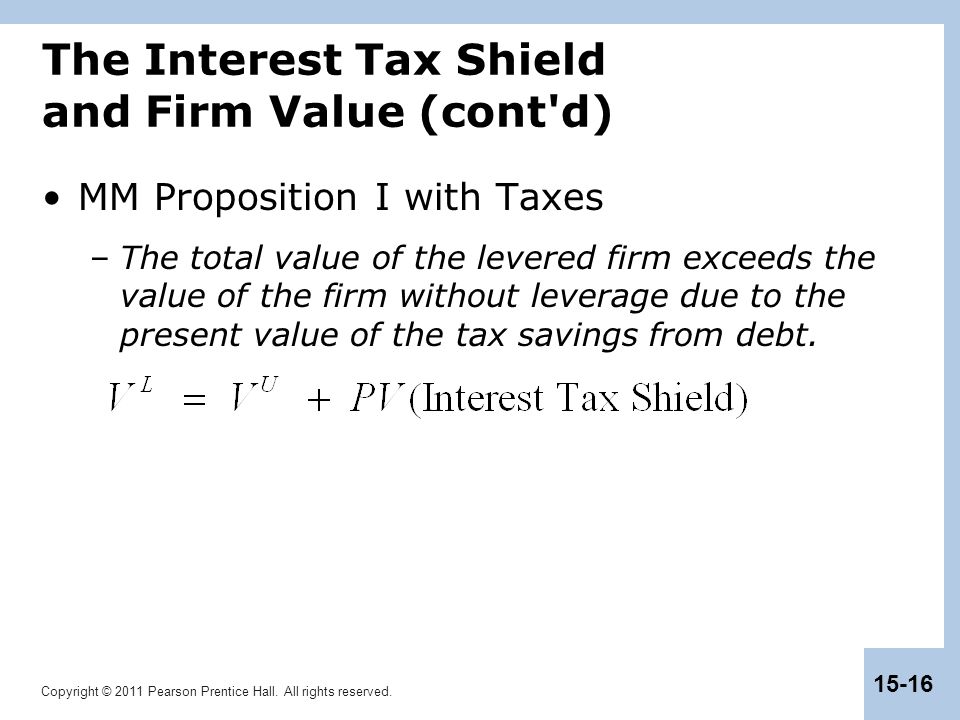

Chapter 15 Debt And Taxes Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Modigliani And Miller Part 2 Youtube

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Interest Tax Shield Formula And Calculator Excel Template

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples